Join Our 3,500,000+ Community

Earn. Play. Win. Repeat.

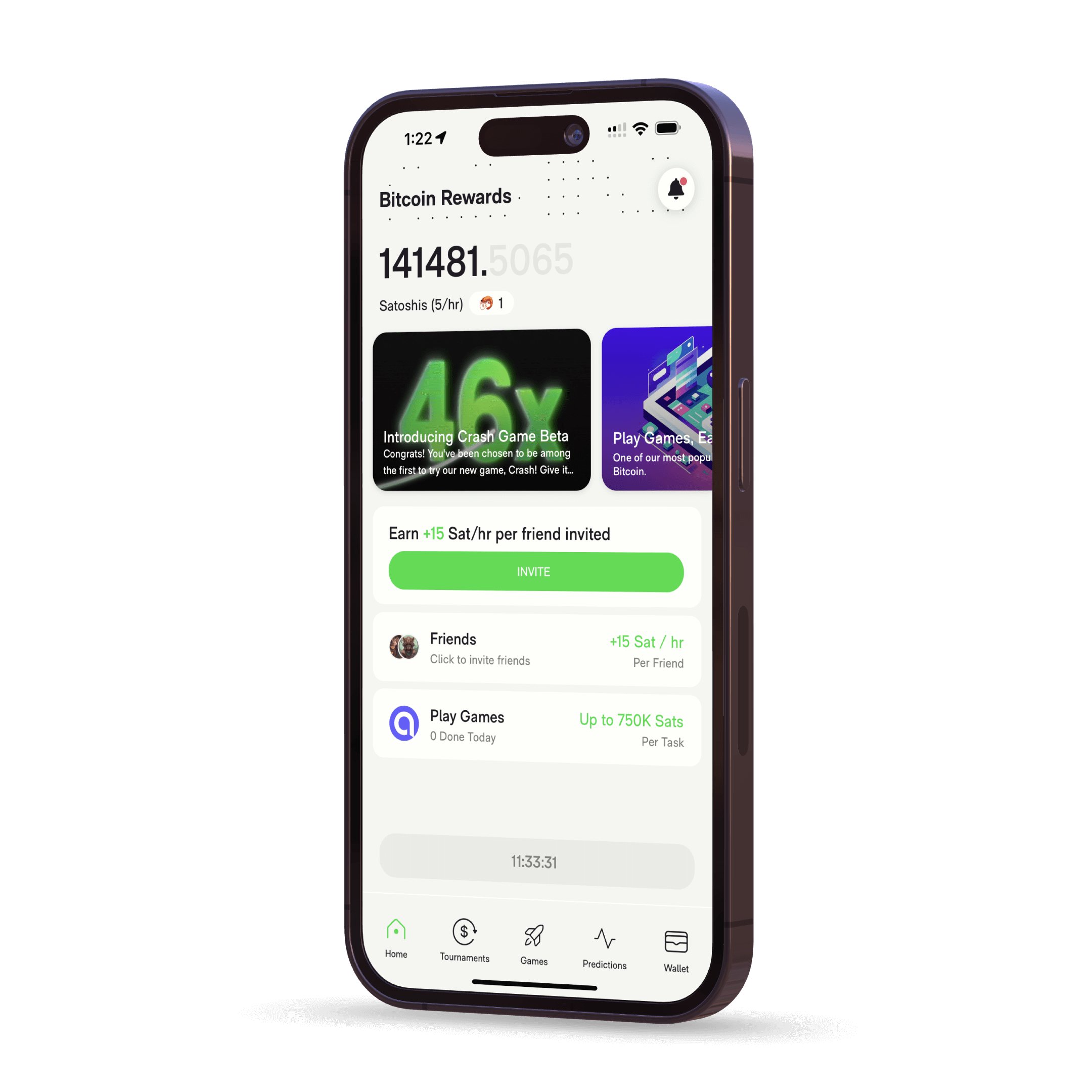

Your gateway to Web3: Earn Satoshi Rewards, bet on sports and play games with friends—all in one app.

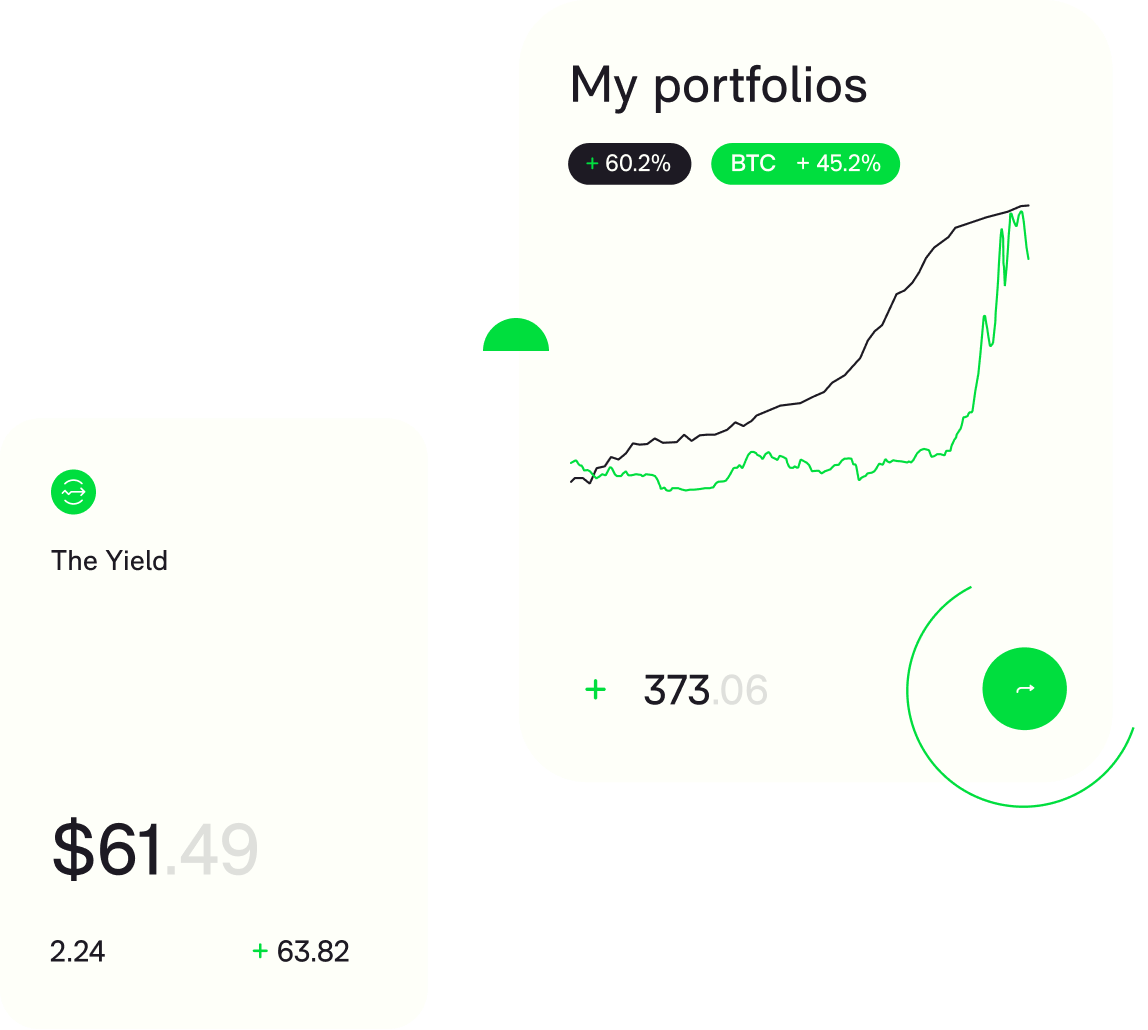

Win Sats through Prediction Markets

Guess the correct outcomes of sports matches and other current events to win big!

This app has one of the biggest daily accumulations you'll find for free mining. The in-game purchase rewards are legit (spend $2.99, get 17k sats for example), and though it only pays out one day a month, it pays out. I've received every withdrawal I've put in for exactly when it said I would. This app is worth it, 100%

Cliff

Why Ember

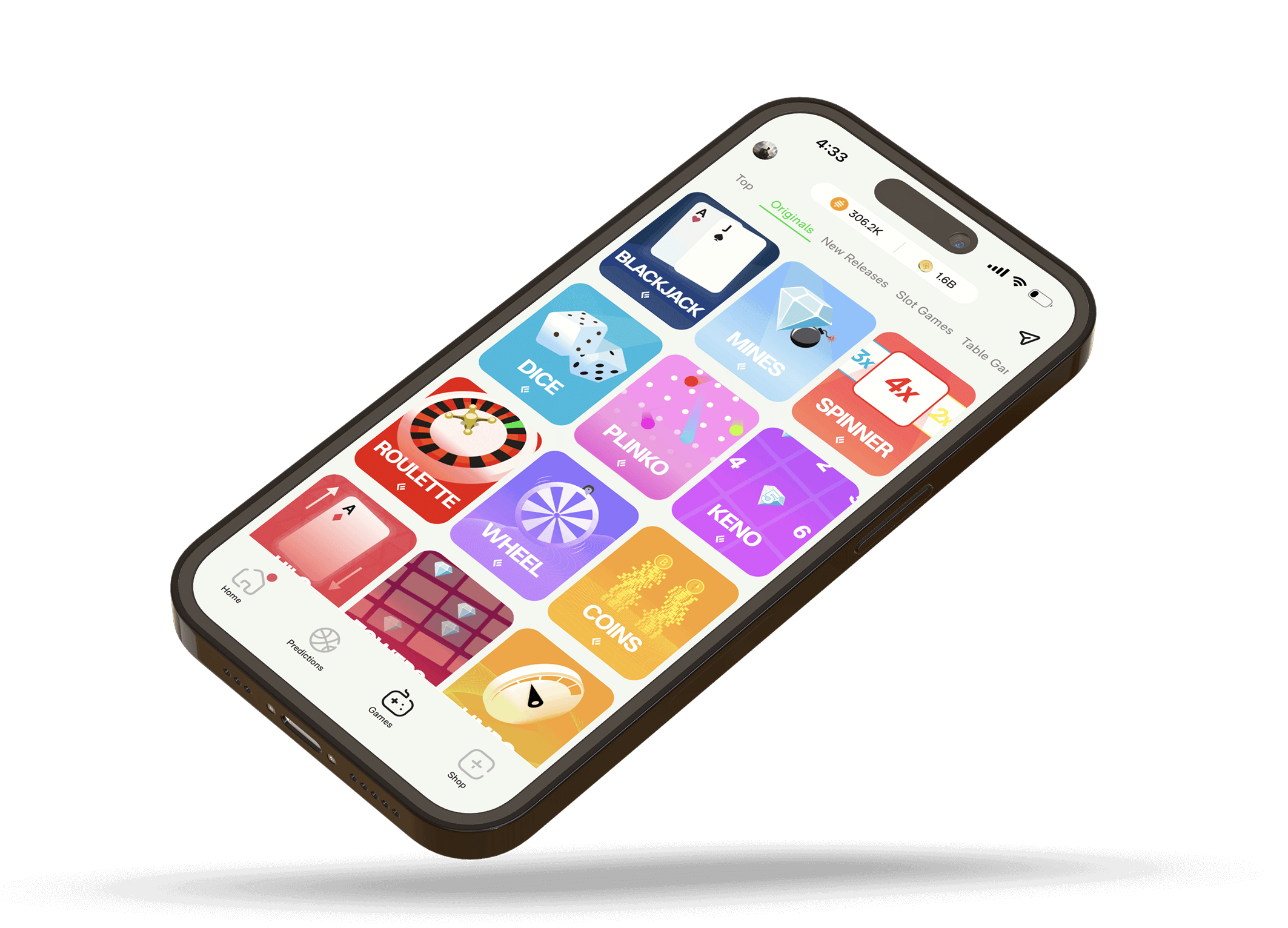

Fun Games. Free to play. Web3 Community. No purchase necessary.

Featured in