Join Our 3,000,000+ Community

Ember Nuggets #34 - Illuvium Beta Is Live; Land Sale Starts This Week! ⚡⚡

Nugget #1: Illuvium ($ILV) starts to hit the limelight, the BETA is live and their land sale starts this week

Illuvium is a highly anticipated open-world game that hopes to be the first AAA title in the blockchain space. The game was announced early last year and has slowly been building momentum and hype with its sleek visuals and recently released beta. Most games launching in crypto have lacked strong mechanics, sustainable tokenomics, and lackluster visuals (let’s be honest most games look like they are from the 70s/80s). The game is a 3D open-world that lets you explore and capture creatures called Illuvials (aka Pokemon) and lets you do arena-style combat. The game is built on Ethereum and based on the NFTs. The token $ILV trades at ~$267 today down from its ATH but well above its launch price. The doxed team and exemplary execution to date give us confidence in the long-term potential of $ILV, it is also a top holding in the Ember Metaverse index.

Now, the land sale. As a comp, we can reference Yuga Labs’ Otherside land sale which was a 300 $APE (~2E) fixed-price sale back in April that now trades at a floor price of 2.83E. 100K units were minted and another 100K units will be given to users over the coming months leading to a total supply of 200K. ILV will have 100K units total of land, of which, 20K units will be available in the first sales via auction.

ILV Land Sale Details and Mechanics:

The land sale will take place between June 2 (13:00 UTC / 9:00 am EST) and June 5 (13:00 UTC / 9:00 am EST).

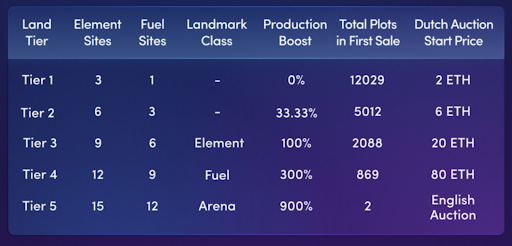

Tiers/Price/Quantity:

There are five tiers of Land from 1 to 5. The higher the tier the better rarity and higher in-game token generation/fuel. The fuel will be the in-game currency that will be tradable for ETH and other items. Tier 1-4 will be sold via Dutch auction with the lowest starting at 2E and the highest at 80E and decreasing 2.5% per minute. Tier 5 land will be sold via English auction and go to the highest bidder – it will be the spot where ILV hosts esports tournaments (only 2 available this round). See the table below for a breakdown of the tiers.

Land can be purchased with either ETH or sILV. All ETH generated from the land sale event will be converted to ILV and distributed to ILV stakers. sILV will be burned, gone forever. In my opinion, this is a plus for both the ILV token and the community – creating demand and rewarding holders.

So these are some brief details on ILV and the upcoming land sales. Our big takeaways and key things to watch in the coming months:

Beta gameplay, community reaction, and reviews

IMX Layer 2, ILV DEX – customized protocols built by ILV to make the game transactions and user experience more efficient

Adoption

Supply and Demand for FUEL in-game – can it create the sustainability seen with gems in Clash of Clans and avoid the fate of Axie with AXS/SLP

Nonetheless, we are excited and will continue to follow the community and game development. I am personally a big Pokemon fan and excited to see what ILV has built.

For more details from the source check it out here.

Nugget #2: Where does yield come from on DeFi? Oversimplified…

There are various types of yield farming:

Liquidity Providing: This is where you stake two assets on a decentralized exchange (DEX) and provide trading liquidity for users that may be buying or selling those assets. The exchange will typically charge a few to the trader and will then pay that fee out to the LP. For example, I could provide $100 of ETH and $100 of USDC on Uniswap and generate some fees every time I swap one for the other.

Lending: Token holders can lend assets on protocols like AAVE or Compound and earn interest paid by the borrowers on the loan. The interest is typically generated by the inherent supply/demand of the token and often supplemented by the protocol token. For example, I may earn 2% on USDC but Compound may pay a “boost” with its governance token (COMP) and boost the yield to 5%.

Borrowing: Token holders can lend assets on protocols like AAVE or Compound and earn interest paid by the borrowers on the loan. The interest is typically generated by the inherent supply/demand of the token and often supplemented by the protocol token. For example, I may earn 2% on USDC but Compound may pay a “boost” with its governance token (COMP) and boost the yield to 5%.

Staking: There are two types of staking. Proof of Stake to support a network, akin to ETH 2.0, where you generate fees created by the network and protocol staking, in which the underlying token is provided as an incentive to lockup specific tokens.

Don't miss out on our latest posts

December 27, 2024

2024 Year In Review & Future 🥂 ️🔥

Let’s dive into what we’ve achieved this year and what’s on the horizon!

December 17, 2024

5M SAT HOLIDAY GIVEAWAY!! 🔥🎄

BTC’s been going to the moon recently, it’s almost Christmas, so why not celebrate with a HUGE 5,000,000 Sat giveaway? LFG!!

June 20, 2024

New Mining Withdrawal Option! 💸

Ember partnered with popular gaming platform Roobet.com as a secure & fun method for mining withdrawals! This feature comes with a HUGE set of upgrades to our withdrawal process.