Join Our 3,500,000+ Community

Ember Nuggets #5

What are Ember Nuggets?

Ember Nuggets are a weekly update with commentary from the investment team on what’s happening within the crypto market - news, developments, market trends, and more.

For more content like this, don't forget about our learn and earn program!

Nugget 1: Coinbase and the SEC

Coinbase had originally planned to launch its Lend product to customers later this year. The Lend product would allow customers to earn 4% APY on their USDC deposits sitting with Coinbase custody. The SEC was uncomfortable with Coinbase taking custody and lending out the underlying assets with partners to generate the 4% Yield. There was a public spat between CEO Armstrong and the SEC - where the SEC issued a Wells notice, basically telling Coinbase that if the product launched, the SEC would sue them. After some back and forth, Coinbase has officially dropped the Lend product for the near future.

Why does this matter?

The SEC led by Gary Gensler is focused on regulating the crypto market, that has gone relatively unchecked since inception. Earlier this year, we saw regulators begin reviewing business practices of Blockfi and Celsius, to name a few. The main sticking point is that a 3rd party company is taking assets on behalf of customers and creating a market to earn yield through partners. SEC’s concern - it’s a completely unregulated market where customer funds could be at risk without the proper checks and balances.

Nugget 2: NFT market cooled off

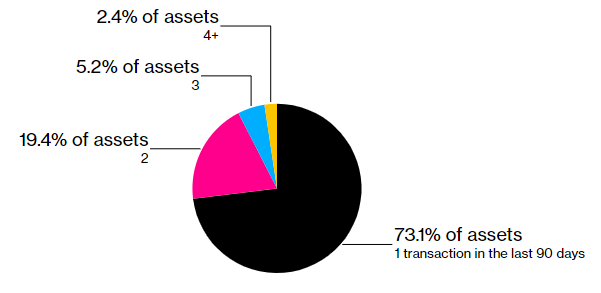

Data from OpenSea suggests that 73.1% of NFT assets had only one transaction in the past 90 days. Furthermore, daily sales data from Nonfungible suggests a decline from a high of 138K (8/30/21) to 42K (9/21/21).

This is quite concerning for NFT collectors, especially in a market with highly speculative purchases and transactions. With the success of CryptoPunks, many investors were jumping into the next NFT project hoping it was a 100x trade. But most projects are highly illiquid and many have lost most of their value. Without legitimate backing or roadmap in place, many projects seemed like quick cash grabs. This is shown in the fact that 3% of NFT Collections made up 97% of all dollar value transactions. Blue-chip names seem to be holding their value, but the broader NFT market may cool for now.

Nugget 3: This week's Bitcoin sell off was driven by the broader equity market

China on Monday led to a mass market sell off that rippled across equity markets around the world. China’s Evergrande is a massive real estate conglomerate that is at high risk for insolvency. Investors have been worried about corporate debt in China and the concerns are starting to come to fruition. Evergrande will be a big test for Beijing and the broader market, especially since it may need a $300B bailout (not confirmed). To put that into perspective, the bailout during the Great Recession in 2008 allocated $700B to TARP.

Anyways, it goes to show that crypto has not decoupled from the equity market just yet.

Thank you for reading!

Harsharn Singh

Investment Associate | Ember Fund

Don't miss out on our latest posts

December 27, 2024

2024 Year In Review & Future 🥂 ️🔥

Let’s dive into what we’ve achieved this year and what’s on the horizon!

December 17, 2024

5M SAT HOLIDAY GIVEAWAY!! 🔥🎄

BTC’s been going to the moon recently, it’s almost Christmas, so why not celebrate with a HUGE 5,000,000 Sat giveaway? LFG!!

June 20, 2024

New Mining Withdrawal Option! 💸

Ember partnered with popular gaming platform Roobet.com as a secure & fun method for mining withdrawals! This feature comes with a HUGE set of upgrades to our withdrawal process.